Economic Factors for Wind Projects

With special refererence to Highland New Wind Development

Last Update: 19 February 2005

This page is dedicated to economic information that applies to wind-power projects anywhere in the United States and specifically applies to the Highland New Wind Development project proposed for the northwestern corner of Highland County, VA. Let me say right up front that I am not an economist or tax accountant. I will try to compile factual information on the economics of wind power along with the opinions of recognized experts in this field.

The cover of a brochure for a December 2003 conference in New York titled Financing Wind Power Projects [111 Kb] touts the tax advantages of wind projects, saying, “Federal tax benefits pay as much as 65% of the capital cost of wind power projects in the United States.” They seem proud of this but it transfers millions of dollars from the pockets of ordinary citizens into the pockets of wealthy developers every year. I will discuss all of these issues in the following paragraphs.

The Production Tax Credit

The production tax credit is a direct credit against a company’s federal income tax based on the generation of electricity from renewable resources such as wind, solar, geothermal, etc. It tends to apply mainly to wind power at this time since that is the most developed form of renewable power. It is not a tax deduction such as an individual gets by contributing to a charity. It is a direct credit applied to the bottom line of the tax bill, essentially cash money from the taxpayers to the developer of the wind project. The PTC was enacted by Congress several years ago. It was given a specific expiration date but that date has been repeatedly extended. It now expires on 31 December 2005 but it is likely to be renewed again.

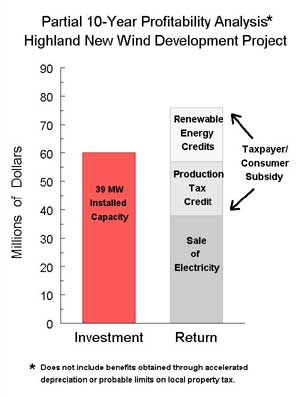

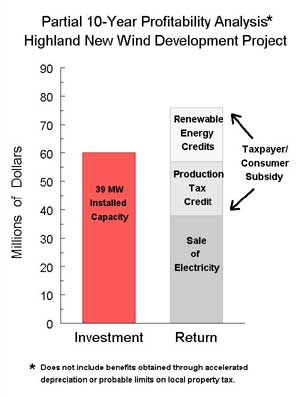

The amount of the PTC is now 1.8¢/KWH of electricity delivered to the grid during the first ten years of operation of the plant. It does not depend on the installed capacity of the wind plant. HNWD plans to install turbines totaling 39 MW capacity at a cost of $60M. In order to figure the amount of their PTC benefit the capacity factor must be considered.

The Capacity Factor

The capacity factor is a measure of how much electricity is actually generated compared to the theoretical maximum. The wind does not blow all of the time or at the ideal speed. Turbines begin to generate at about 8 MPH, reach full power at about 30 MPH, and are shut down to protect the mechanism at about 55 MPH. The CF accounts for down time as well as time spent generating at partial capacity. A study of the Top of Iowa Wind Farm by the Iowa Department of Natural Resources found a CF of 27.7%. [80.1 MW of installed capacity x 730 hr/month = 58,473 MWH/month maximum output. Actual production averaged 16,193 MWH/month for 2002. The ratio of actual to maximum output is the capacity factor.] On the ridges in the middle Atlantic area it runs somewhere around 30%.

For HNWD’s 39 MW plant this means an output of about 12 MW or 12,000 KW. There are 24 x 365 = 8760 hours in a year x 12,000 KW = 105 million KWH. Therefore the PTC of 1.8¢/KWH will yield a direct benefit in the form of a tax credit to HNWD of about $1.9M per year or nearly $19M over ten years, about 1/3 of the original investment.

Renewable Portfolio Standards

Various states, not [at this time] including Virginia, have enacted laws specifying Renewable Portfolio Standards, which is a fancy way of saying that utilities in those states must supply a certain percentage of their power from renewable sources — wind, solar, etc. — basically the same sources that qualify for the PTC. This creates a demand for renewable power, as it is supposed to, but primarily a demand for wind power since that is generally the least expensive renewable source, at least in this area, and especially if not all costs are internalized (we will get into that later).

The generation cost of conventional electricity in this area is about 3.5 to 4¢/KWH. Wind-generated electricity costs the producer some 6 to 6.8¢/KWH. Subtracting the PTC, one has a net cost of 4.2 to 5¢/KWH. Utilities are willing to pay this extra cost for wind energy in order to comply with RPS laws. If the utility serving the immediate area where the wind plant is located does not have RPS compliance issues, more distant utilities can satisfy their RPS requirements by buying Renewable Energy Certificates.

Renewable Energy Certificates

The REC provides a way for utilities with no direct access to “green” energy to satisfy their RPS requirements. RECs can be traded among utilities so that a utility in New York, for example, might buy RECs from HNWD, thus meeting its RPS quota and being able to claim that it is using a renewable source of energy. Electrons all look alike, of course, and once on the grid a “renewable” electron cannot be distinguished from a “conventional” electron.

Since RECs sell for 1.5 to 2¢/KWH, HNWD can now sell its power to the local utility at or below the prevailing conventional cost and still make money. We saw, above, that the PTC generates some $19M over ten years and now the sale of RECs will produce a similar amount of income, while the sale of the electricity itself will produce about double that amount.

Since RECs sell for 1.5 to 2¢/KWH, HNWD can now sell its power to the local utility at or below the prevailing conventional cost and still make money. We saw, above, that the PTC generates some $19M over ten years and now the sale of RECs will produce a similar amount of income, while the sale of the electricity itself will produce about double that amount.

So we now have a $60M project that will bring in $19M from taxpayers all over the country, another $19M from the electricity customers of the utility that bought the RECs, and some $38M from the sale of the electricity to the same or another utility. The company now has sales and credits of $76M on a $60M investment, less costs for maintenance, administration, taxes, etc., and the lifespan of the equipment should allow production to continue for another 10 to 15 years.

What’s not to like? Nothing, as long as you don’t mind paying higher income taxes to support the PTC and higher electric bills to support the sale of the RECs. For the developer it really is pretty cushy — generous tax handouts and government policies that more or less require utilities to buy the product. But wait, there’s more.

Accelerated Depreciation

Normally an electrical generating plant is depreciated for tax purposes on a straight-line method over 20 years. That means that for a plant worth $1M the owner can deduct from his net income $50,000 every year for 20 years to figure his taxable income. In the case of its $60M investment, HNWD would deduct $3M each year. However, wind turbines receive yet another government preference. The owner may take accelerated depreciation on what is known as a 5-year double-declining balance schedule. This means that he can deduct more than half of his investment in the first two years and all of it within six years. The same total deduction is allowed in either case but under DDB one gets one’s tax benefit much sooner so one can invest the money in something else — perhaps more wind turbines.

So the owner is getting rich at the expense of the taxpayers and ratepayers. Doesn’t anyone else benefit? If the developer rents the land for the project then the landowner collects around $2500/year/turbine in rent. {The slide at the top of this page indicates $2500-4000/year/MW but rates in this area do not seem to go that high.) In the case of HNWD, Mr. McBride owns the land so he keeps that money in his pocket. But what about the local municipality? Doesn’t it reap a windfall in property taxes?

Local Property Taxes

Local taxation is an iffy proposition. Some states have declared wind plants exempt from local taxation so for them the answer is zero. Virginia has not ruled on this so far so we are in unknown territory. If the State Corporation Commission treats a wind plant in the same way as a conventional power plant then Highland County should receive $248K/year in property taxes. Bear in mind that wind plants are given special treatment in almost every other way so the SCC could easily take away some or all of this. It is also unclear what depreciation schedule would apply but what starts out at $248K will surely drop as the value of the plant declines over time. A bill now moving through the VA legislature, Senate Bill #1011, would limit local taxation of wind projects to $3000/year/MW of installed capacity. If enacted, this would yield $117K per year to Highland County. It seems that this provision might override depreciation so that this amount would be paid to the county each year for the life of the project — but this has not been confirmed. The NREL slide at the top of this page not only highballs potential tax revenue but fails even to mention the downside risk that a project could be ruled exempt.

Then there are tradeoffs to consider. If the presence of the wind plant causes a decline in the value of surrounding properties, which is likely, then there will be a reduction is tax revenue from those properties. Furthermore, if some people decide not to buy land or build new homes on land they already own, that will mean lost tax revenue also. The present Highland County tax rate is 0.67% or about $2000 on a $300,000 home. And that is tax revenue that would be here for the long haul and which would go up as property values appreciate. Meanwhile, revenue from the wind pant is going down as the plant depreciates. It would take some research to figure these tradeoffs but I will speculate that the revenue loss from 20 to 30 new homes that are not built would totally wipe out the gain in revenue from the wind plant within 20 years.

Local Jobs and Services

Items 3, 4, and 5 on the NREL slide are more difficult to analyze and are very much site specific. It states that the concrete and towers are “usually done locally.” There are no concrete plants in Highland County and the two small plants in nearby WV would be severely taxed to put out the volume required, if they could do it at all. There is no equipment in Highland or the surrounding area capable of erecting the towers and there is no available labor force to fill 40 to 80 construction jobs if they were offered. In short, outside contractors will erect the turbines using equipment, materials, and labor largely brought in from elsewhere. There would be a few short-term jobs filled by Higlanders and local conveneince stores and restaurants would see a brief surge in business.

As far as permanent jobs go, the facility would need to hire several operation and maintenance people. At least one would likely need specialized training. Highlanders might be hired for these jobs but they could just as easily go to nearby West Virginians. Outsiders could also fill the jobs and they could take up residence in Highland or elsewhere. We are only talking about 2 or 3 jobs in any case, which would have little effect upon the total job picture in the county.

Transmission and Generation Costs

Most wind projects would require the construction or upgrading of transmission lines. The HNWD project is ideally located in this respect, as a 69 KV transmission line with sufficient available capacity to carry the output crosses the HNWD property. If the project were to expand in scope this line would have to be upgraded to 138 KV at a cost of around $500K/mile plus a new 138 KV substation at $1M+.

Wind power is non-dispatchable, which means that power managers cannot have it turned on as demand rises and ramped back as demand declines. Wind power is there only when the wind blows. This means that higher-cost transmission lines must be built to carry the peak load and much of that capacity will be unused most of the time. Similarly, the variable and unpredictable power output means that conventional power plants must be kept up and running to be ready to pick up the slack when the wind diminishes. Thus there is very little reduction in coal consumption or CO2 emissions when the wind is blowing because the conventional plant cannot be shut down. There is even some evidence indicating that a coal-fired plant emits more pollutants operating below capacity than it does when running at full capacity. If that is true it leads one to the ironic conclusion that wind turbines might even increase CO2 emissions. More research is needed to confirm or refute this effect.

Replacement of Conventional Power Plants

The wind industry would have one believe that the installation of wind turbines will lead to the closure of conventional coal-fired or nuclear power plants. In addition to the need for back-up generation discussed above, it would take prodigious numbers of wind turbines to have any significant effect on the operation of other power plants.

Let us take as an example the Mount Storm coal-fired plant and the nearby Mountaineer wind plant. Mount Storm is a 1662 MW plant operating at an average CF of 0.80 for a net output of 1330 MW or 11,650 GWH/year. Mountaineer’s 44 turbines total 66 MW with a 0.30 CF yielding 173 GWH/year, approximately 1.5% of Mount Storm. Thus it would require 67 Mountaineer plants or 2955 turbines to equal Mount Storm. Since turbines are typically installed at about 8/mile this would require about 370 miles of ridge top to be developed. The capital investment would be roughtly $6.6 billion. [2955 turbines = 4432 MW x $1.5M/MW]

Wind generation of 11,650 GWH/year would bring the developer $210M/yr from the PTC or $2.1 billion over ten years, directly from the Federal treasury, our tax dollars at work. Sales of REC would bring in a similar windfall, directly from electric rate payers, our utility dollars at work. Despite all of this investment, tax subsidy, and increased electric rates it would still not be possible to shut down the Mount Storm plant as it would be needed for back-up generation when the wind was not blowing in the ideal speed range.

References

- Case Study of the Top of Iowa Wind Farm by the Iowa Department of Natural Resources. [70 Kb]

- State and Local Economic Impact of “Wind Farms” using Highland County as an example, by Glenn R. Schleede, 28 April 2004. [213 Kb]

- Facing up to the true costs and benefits of wind energy, by Glenn R. Schleede, 24 June 2004, 22-page report presented to the American Electric Cooperative annual meeting. [240 Kb]

- Economic report by Michael Siegel, 20 May 2004, prepared specifically for Highland County, was presented at an information meeting in Monterey. [77 Kb]

- NOTE — At the time the above reports were prepared the HNWD proposal was for 50 MW and Highland’s tax rate was 0.62%. Little else has changed.

- Financing Wind Projects Through the Voluntary Green Power Market, by Kathy Belyeu, American Wind Energy Association, October 2004. This article discusses the PTC and REC and other schemes to induce taxpayers and ratepayers to support otherwise unprofitable wind energy projects.

- Generation records for US power plants in spreadsheet format, 2002 - 2004, U.S. Department of Energy, Energy Information Agency report forms 906 and 920.

John R. Sweet, Mustoe, VA

Return to the top of this page or go back to the main wind page.

Since RECs sell for 1.5 to 2¢/KWH, HNWD can now sell its power to the local utility at or below the prevailing conventional cost and still make money. We saw, above, that the PTC generates some $19M over ten years and now the sale of RECs will produce a similar amount of income, while the sale of the electricity itself will produce about double that amount.

Since RECs sell for 1.5 to 2¢/KWH, HNWD can now sell its power to the local utility at or below the prevailing conventional cost and still make money. We saw, above, that the PTC generates some $19M over ten years and now the sale of RECs will produce a similar amount of income, while the sale of the electricity itself will produce about double that amount.